There are over 10,000 cryptocurrencies! And we only invest in two at GK? Why is that?

This isn’t to say there aren’t excellent projects out there with solid motivation, but they are riskier.

Immediately when looking at who typically invests in crypto there are clear gender gaps, but is that surprising? There are more men in traditional finance, engineering, computer science, and gaming and all of those spaced fused together is basically bitcoin.

You don’t need to know how a car engine works to understand that driving it can get you from point A to point B.

“Ownership of cryptocurrencies can raise additional unique issues regarding estate tax liability and reporting.”

For someone to access your cryptocurrency, they would need your private keys. This is quite a hurdle to get over when thinking of crypto as an inherited asset because how do you guarantee that your beneficiary receives the keys. More TOD or POD accounts need to become mainstream as these assets are popularized.

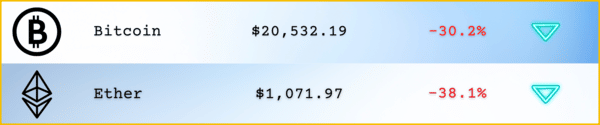

A combination of market forces is quickly converging with a significant bearish feedback loop; rising inflation, rising interest rates, downturns in traditional finance, and rising volatility. All of which is shaking investor confidence. People are dumping their crypto quickly and looking for safer assets.

Crypto continues to be on a downturn, but there are HUGE players now entering the space. What does this mean for the future of crypto?